MB-310 Online Practice Questions and Answers

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while

others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has multiple legal entities set up in Dynamics 365 for Finance and Operations. All companies and data reside in Finance and Operations.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Finance and Operations instead.

You need to configure the system and correctly perform eliminations.

Solution: Select Consolidate with import.

Does the solution meet the goal?

A. Yes

B. No

You work as the Finance Manager for a company. The company uses Microsoft Dynamics 365 Finance for its accounting system.

You are configuring the system to ensure that when creating sales orders, the sales tax is automatically calculated when an item is added to a sales order line.

When testing the configuration, you discover that the sales tax is not calculated for the sales order line.

You need to verify the configuration.

Which of the following should you check?

A. Ensure that the sales tax code is associated with both the sales tax group and the item sales tax group.

B. Ensure that the sales tax code is associated with the sales tax group but not the item sales tax group.

C. Ensure that the sales tax code is associated with the item sales tax group but not the sales tax group.

D. Ensure that the sales tax code is not associated with either the sales tax group or the item sales tax group.

Your role of Systems Administrator includes the management of your Prepaway company's Microsoft Dynamics 365 Finance system.

Departmental managers need to be able to select different fiscal periods when configuring their budgets.

You need to configure the budgeting module to meet the requirements.

Which of the following should you configure?

A. Budget cycles

B. Budget groups

C. Budget register entries

D. Budget control

E. Budget codes

An exchange rate provider has been configured for Dynamics 365 Finance.

Foreign currency transactions using the Euro and the US dollar use a fixed exchange rate for European Central Bank holidays and all days between April 1 and June 30. Foreign currency transactions from March 1 to June 30 fail to post.

You need to reconfigure the system to post transactions for this period.

Which two configuration changes should you make to the ledgers? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

A. Add a key named FloatCurrencies and set the value to True.

B. Set Create necessary currency pairs to True.

C. Set Import as of start date to Apr01.

D. Add a key named BaseCurrency and value of USD.

E. Set Prevent import on national holiday to True.

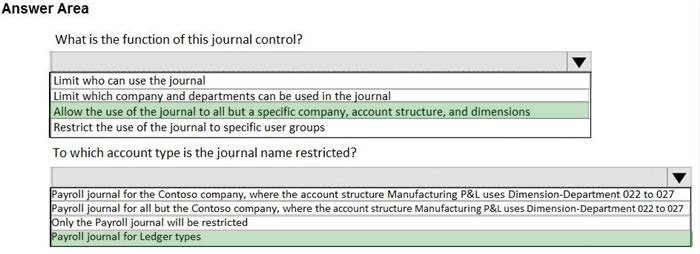

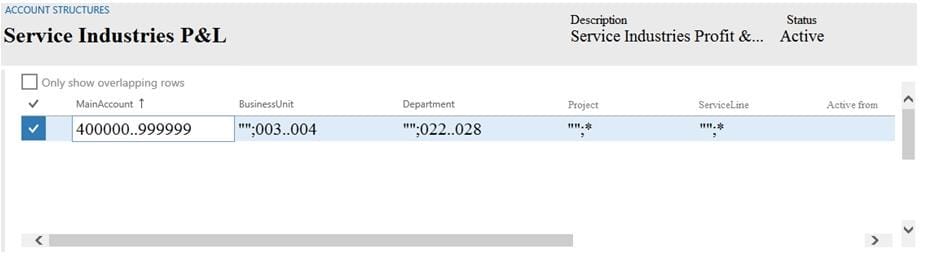

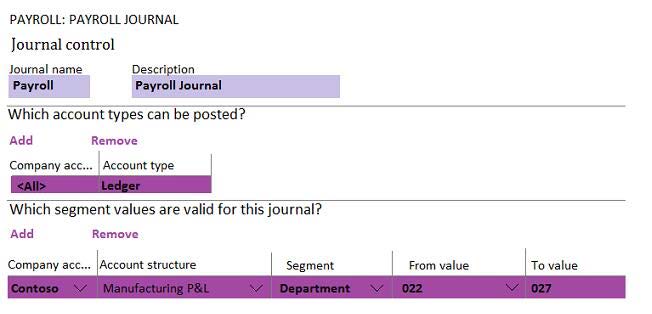

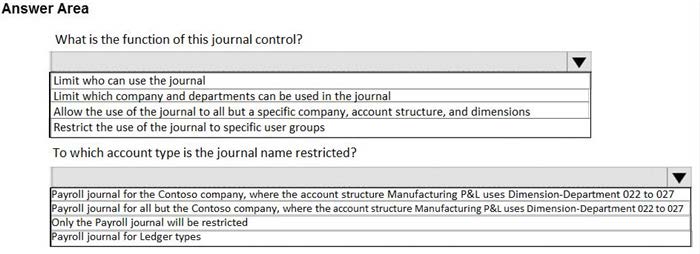

HOTSPOT

You must configure journal controls in Dynamics 365 Finance.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point.

Hot Area:

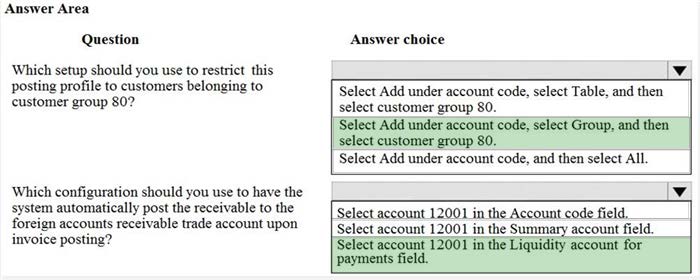

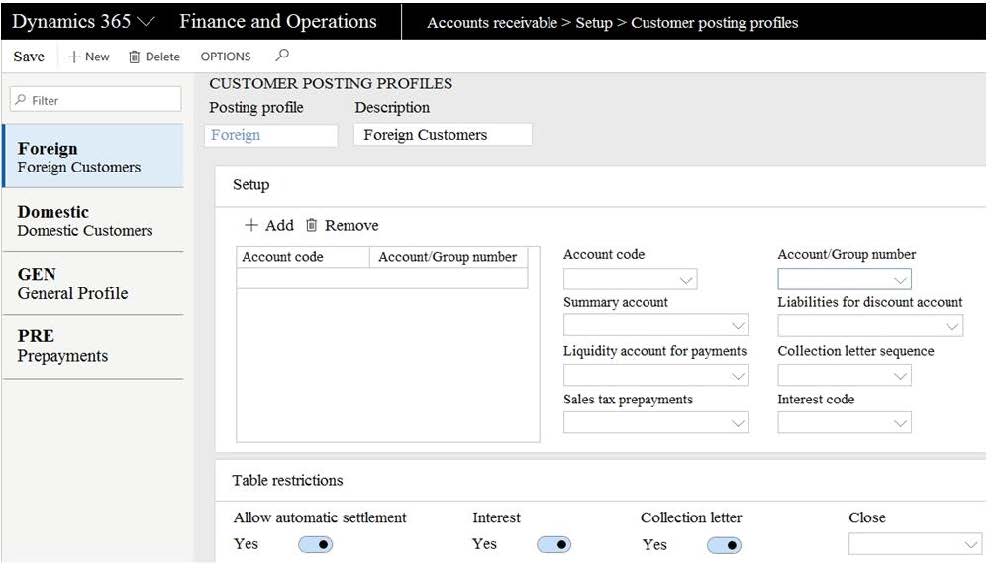

HOTSPOT

A client is using Dynamics 365 Finance for sales order processing and accounts receivable. The client has two customer groups and two Accounts receivable trade accounts. Foreign customers in Group 80 are assigned to account 12001.

Domestic customers in Group 40 are assigned to account 12000.

You are viewing the client's current setup of Customer posting profiles.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point.

Hot Area:

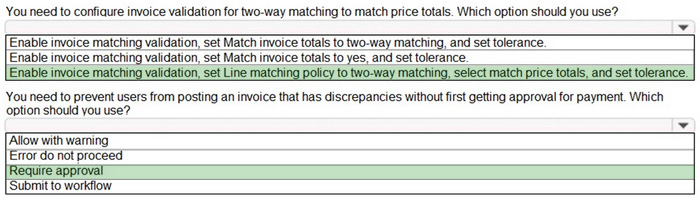

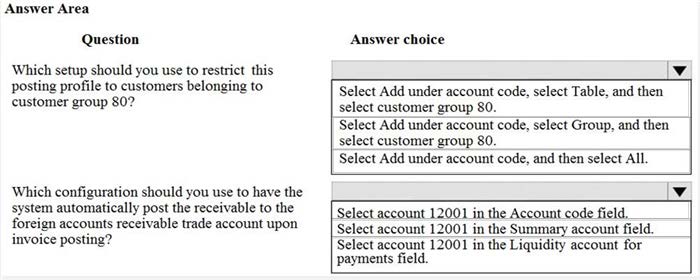

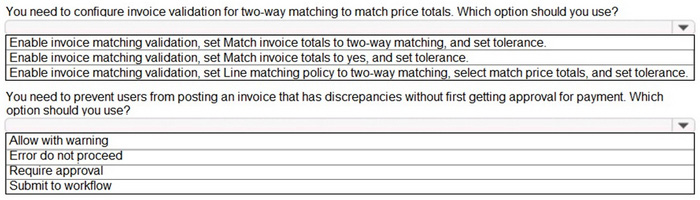

HOTSPOT

You need to configure invoice validation for vendors in Dynamics 365 Finance.

You are viewing the Accounts payable parameter for Invoice validation.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Hot Area:

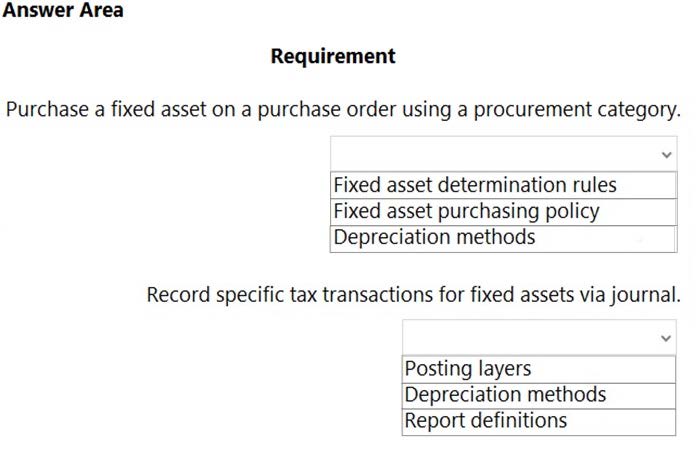

HOTSPOT

A company is implementing Dynamics 365 Finance.

The company purchases fixed assets using a purchase order. The company must post tax-specific transactions related to the fixed assets so the transactions can be reported separately.

You need to configure the system.

What should you configureTo answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

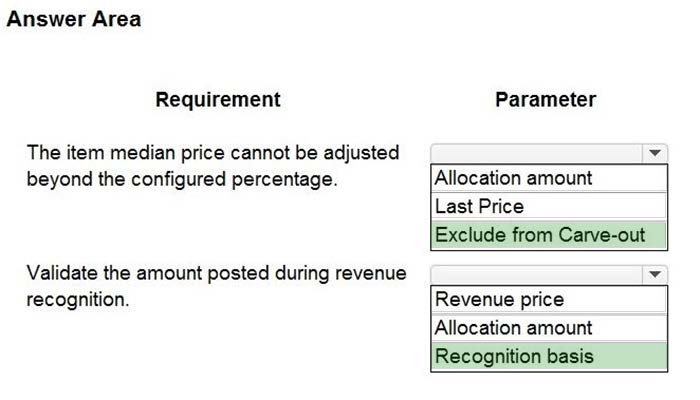

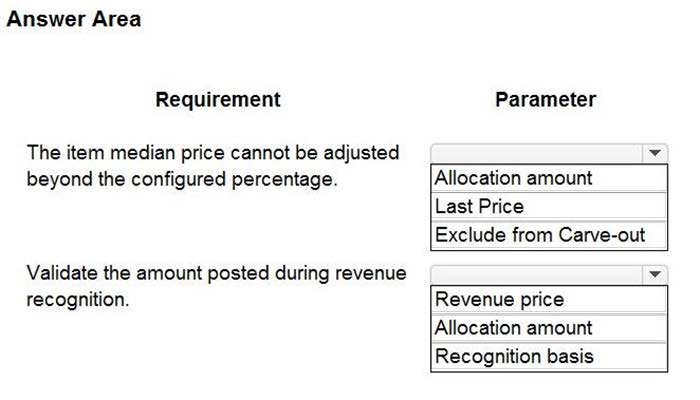

HOTSPOT

A company manufactures and installs units for industrial manufacturing plans.

Revenue for the units recognized based on a median price when the unit install. A three-year warranty is sold with each unit. Revenue for the warranty is recognized equally in each year the warranty covers.

You need to configure and process revenue recognition.

Which parameter should you configure? To answer select he appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

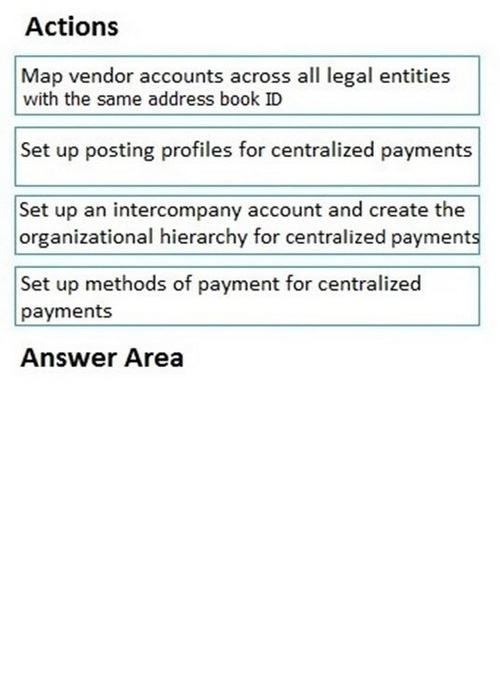

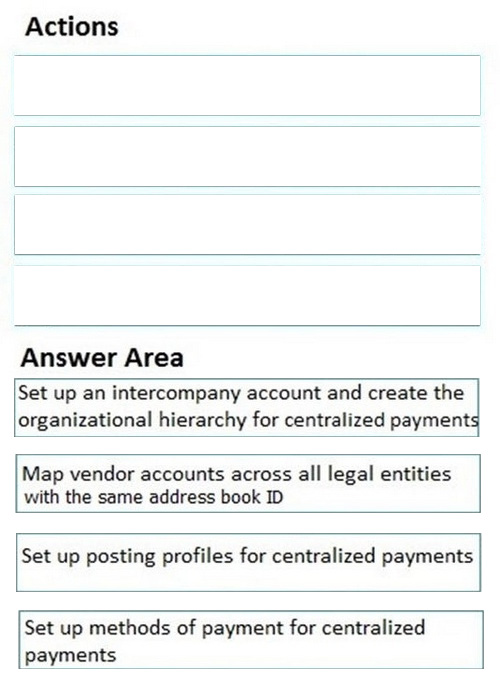

DRAG DROP

You are a Dynamics 365 Finance functional consultant. A legal entity processes and settles vendor payments on behalf of other legal entities in an organization.

You need to configure the centralized payment flow for the legal entity.

In which order should you perform the actionsTo answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Select and Place: