IMANET-CMA Online Practice Questions and Answers

Intense rivalry among firms in an industry increases when there is

l- A low degree of product differentiation ll- Low consumer switching costs

A. l only

B. ll only

C. Both l and ll

D. Neither l nor ll

Marketing research may rely on primary or secondary sources of information. Which research approach gathers primary information through moderated discussions?

A. Surveys.

B. Focus groups.

C. Experimentation.

D. Evidence of purchasing behavior.

Which one of the following is not an element of the strategic marketing process?

A. Customer segmentation

B. Market selection

C. Value positioning

D. Product pricing

The benefits of diversification decline to near zero when the number of securities held increases beyond.

A. 4

B. 6

C. 10

D. 40

Malony, Inc.'s $1,000 par value preferred stock paid its $100 per share annual divided on April 4 of the current year. The preferred stock's current market price is $960 a share on the date of the dividend distribution. Maloney's marginal tax rate (combined federal and state) is 40%, and the firm plans to maintain its current capital structure relationship. The component cost of preferred stock to Maloney would be closest to

A. 6%

B. 6.25%

C. 10%

D. 10.4%

Osgood Products has announced that it plans to finance future investments so that the firm will achieve an optimum capital structure. Which one of the following corporate objectives is consistent with this announcement?

A. Maximize earnings per share.

B. Minimize the cost of debt.

C. Maximize the net worth of the firm.

D. Minimize the cost of equity.

Cost-volume-profit (CVP) analysis is a key factor in many decisions, including choice of product lines, pricing of products, marketing strategy, and use of productive facilities. A calculation used in a CVP analysis is the breakeven point. Once the breakeven point has been reached, operating income will increase by the

A. Gross margin per unit for each additional unit sold.

B. Contribution margin per unit for each additional unit sold.

C. Fixed costs per unit for each additional unit sold.

D. Variable costs per unit for each additional unit sold.

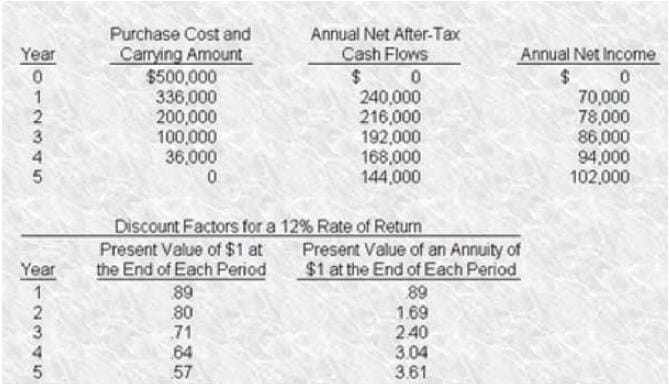

A proposed investment is not expected to have any salvage value at the end of its 5-year life. Because of realistic depreciation practices, the net carrying amount and the salvage value are equal at the end of each year. For present value purposes, cash flows are assumed to occur at the end of each year. The company uses a 12% after-tax target rate of return.

The accounting rate of return based on the average investment is

A. 84.9%

B. 344%

C. 40.8%

D. 12%

In an insourcing vs. outsourcing decision1 the decision process favors the use of total costs rather than unit costs. The reason is that

A. Unit cost may be calculated based on different volumes.

B. Irrelevant costs may be included in the unit amounts.

C. Allocated costs may be included in the unit amounts.

D. All of the answers are correct.

The tax impact of equipment depreciation affects capital budgeting decisions. Currently, me Modified Accelerated Cost Recover' System (MACRS) is used as the depreciation method for most assets for tax purposes. When employing the MACRS method of depreciation in a capita) budgeting decision, the use of MACRS as compared with the straight-line method of depreciation will result in?

A. Equal total depreciation for both methods.

B. MACRS producing less total depreciation than straight line.

C. Equal total tax payments, after discounting for the time value of money.

D. MACRS producing more total depreciation than straight line