FINANCIAL-ACCOUNTING-AND-REPORTING Online Practice Questions and Answers

According to the FASB conceptual framework, the process of reporting an item in the financial statements of an entity is:

A. Allocation.

B. Matching.

C. Realization.

D. Recognition.

According to the FASB conceptual framework, which of the following statements conforms to the realization concept?

A. Equipment depreciation was assigned to a production department and then to product unit costs.

B. Depreciated equipment was sold in exchange for a note receivable.

C. Cash was collected on accounts receivable.

D. Product unit costs were assigned to cost of goods sold when the units were sold.

How should the effect of a change in accounting principle that is inseparable from the effect of a change in accounting estimate be reported?

A. As a component of income from continuing operations.

B. By restating the financial statements of all prior periods presented.

C. As a correction of an error.

D. By footnote disclosure only.

A transaction that is unusual in nature and infrequent in occurrence should be reported separately as a component of income:

A. After cumulative effect of accounting changes and before discontinued operations of a segment of a business.

B. After cumulative effect of accounting changes and after discontinued operations of a segment of a business.

C. Before cumulative effect of accounting changes and before discontinued operations of a segment of a business.

D. After discontinued operations of a segment of a business.

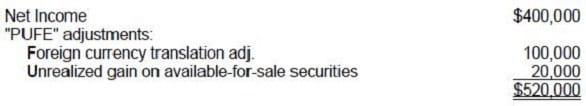

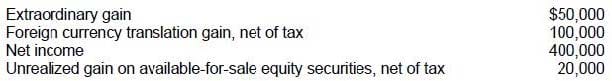

Rock Co.'s financial statements had the following balances at December 31:

What amount should Rock report as comprehensive income for the year ended December 31?

A. $400,000

B. $420,000

C. $520,000

D. $570,000

Which of the following describes how comprehensive income should be reported?

A. Must be reported in a separate statement, as part of a complete set of financial statements.

B. Should not be reported in the financial statements but should only be disclosed in the footnotes.

C. May be reported in a separate statement, in a combined statement of income and comprehensive income, or within a statement of stockholders' equity.

D. May be reported in a combined statement of income and comprehensive income or disclosed within a statement of stockholders' equity; separate statements of comprehensive income are not permitted.

Which of the following statements regarding fair value is/are correct?

I. The fair value of an asset or liability is specific to the entity making the fair value measurement.

II. Fair value is the price to acquire an asset or assume a liability.

III. Fair value includes transportation costs, but not transaction costs.

IV.

The price in the principal market for an asset or liability will be the fair value measurement.

A.

I and II

B.

I and IV

C.

II and III

D.

III and IV

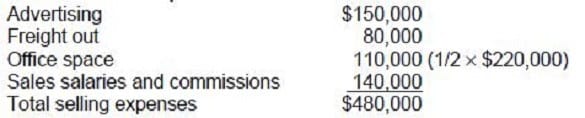

Brock Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The adjusted trial balance at December 31, 1989 included the following expense and loss accounts: One-half of the rented premises is occupied by the sales department. Brock's total selling expenses for 1989 are:

A. $480,000

B. $400,000

C. $370,000

D. $360,000

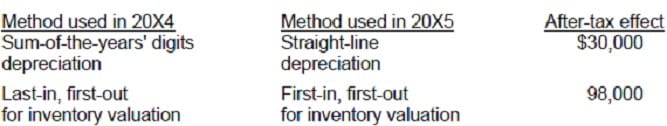

During 20X5, Dale Corp. made the following accounting changes:

What amount should be shown in the 20X5 retained earnings statement as an adjustment to the beginning balance?

A. $0

B. $30,000

C. $98,000

D. $128,000

On January 2, 1993, Quo, Inc. hired Reed to be its controller. During the year, Reed, working closely with

Quo's president and outside accountants, made changes in accounting policies, corrected several errors

dating from 1992 and before, and instituted new accounting policies.

Quo's 1993 financial statements will be presented in comparative form with its 1992 financial statements.

This question represents one of Quo's transactions. List B represents the general accounting treatment

required for these transactions. These treatments are:

•

Cumulative effect approach - Include the cumulative effect of the adjustment resulting from the accounting change or error correction in the 1993 financial statements, and do not restate the 1992 financial statements.

•

Retroactive or retrospective restatement approach - Restate the 1992 financial statements and adjust 1992 beginning retained earnings if the error or change affects a period prior to 1992.

•

Prospective approach - Report 1993 and future financial statements on the new basis but do not restate 1992 financial statements.

Item to Be Answered The equipment that Quo manufactures is sold with a five-year warranty. Because of a production breakthrough, Quo reduced its computation of warranty costs from 3% of sales to 1% of sales.

List B (Select one)

A. Cumulative effect approach.

B. Retroactive or retrospective restatement approach.

C. Prospective approach.