CPA-TEST Online Practice Questions and Answers

Which of the following statements is a basic element of the auditor's standard report?

A. The disclosures provide reasonable assurance that the financial statements are free of material misstatement.

B. The auditor evaluated the overall internal control.

C. An audit includes assessing significant estimates made by management.

D. The financial statements are consistent with those of the prior period.

An annual shareholders' report includes audited financial statements and contains supplementary information required by GAAP. Is it permissible for the auditor to report on such information?

A. No, because such reporting may lead to the belief that the auditor is responsible for the information.

B. No, because the auditor has no responsibility to read the other information in a document containing audited financial statements.

C. Yes, provided the report provides negative assurance only.

D. Yes, provided the auditor performs sufficient audit procedures to determine whether the information is fairly stated, in all material respects, in relation to the financial statements.

Which of the following sets of information does an auditor usually confirm on one form?

A. Accounts payable and purchase commitments.

B. Cash in bank and collateral for loans.

C. Inventory on consignment and contingent liabilities.

D. Accounts receivable and accrued interest receivable.

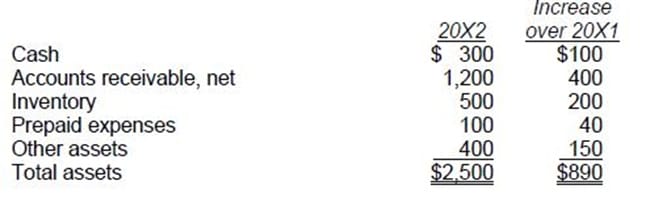

At December 31, 20X2, ABC Co. had the following balances in selected asset accounts:

ABC also had current liabilities of $1,000 at December 31, 20X2, and net credit sales of $7,200 for the year

then ended.

What was the average number of days to collect ABC's accounts receivable during 20X2?

A. 30.4

B. 40.6

C. 50.7

D. 60.8

The scope of audits of recipients of federal financial assistance in accordance with federal audit regulations varies. Which of the following elements do these audits have in common?

A. The auditor is required to disclose all situations and transactions that could be indicative of fraud, abuse, and illegal acts to the federal inspector general.

B. The materiality levels are higher and are determined by the government entities that provide the federal financial assistance to the recipients.

C. The auditor is required to document an understanding of internal control established to ensure compliance with the applicable laws and regulations.

D. The accounts should be 100% verified by substantive tests because certain statistical sampling applications are not permitted.

Which one of the following factors might cause a firm to increase the debt in its financial structure?

A. An increase in the corporate income tax rate.

B. Increased economic uncertainty.

C. An increase in the price/earnings ratio.

D. A decrease in the times interest earned ratio.

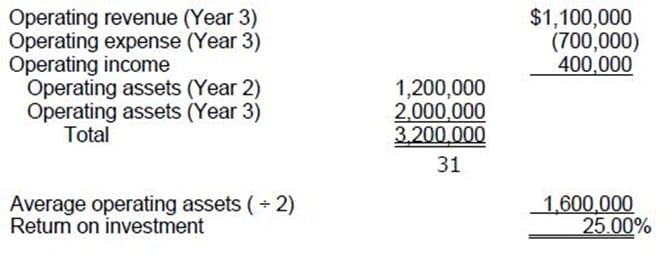

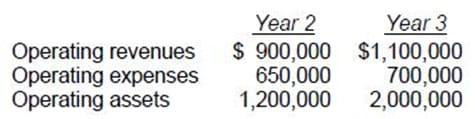

ABC, Inc. made some changes in operations and provided the following information:

What percentage represents the return on investment for year 3?

A. 28.57%

B. 25%

C. 20.31%

D. 20%

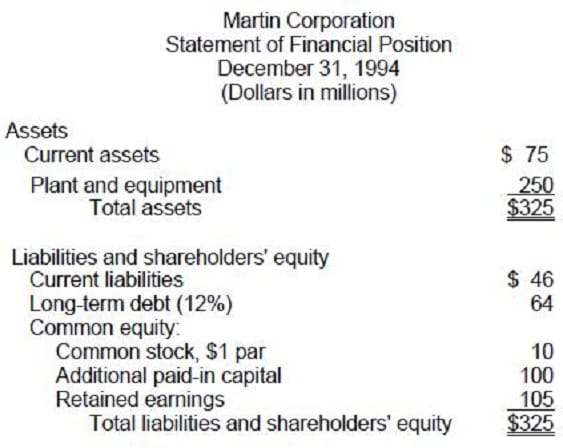

Additional Data

•

The long-term debt was originally issued at par ($1,000/bond) and is currently trading at $1,250 per bond.

•

ABC Corporation can now issue debt at 150 basis points over U.S. treasury bonds.

•

The current risk-free rate (U.S. treasury bonds) is 7 percent.

•

ABC's common stock is currently selling at $32 per share.

•

The expected market return is currently 15 percent.

•

The beta value for ABC is 1.25.

•

ABC's effective corporate income tax rate is 40 percent.

Using the Capital Asset Pricing Model (CAPM), Corporation's current cost of common equity is:

A. 10.00 percent.

B. 15.00 percent.

C. 17.00 percent.

D. 18.75 percent.

Smith made a gift of property to Thompson. Smith's basis in the property was $1,200. The fair market value at the time of the gift was $1,400. Thompson sold the property for $2,500. What was the amount of Thompson's gain on the disposition?

A. $0

B. $1,100

C. $1,300

D. $2,500

Wallace purchased 500 shares of ABC, Inc. 15 years ago for $25,000. Wallace has worked as an owner/ employee and owned 40% of the company throughout this time. This year, ABC, which is not an S corporation, redeemed 100% of Wallace's stock for $200,000. What is the treatment and amount of income

or gain that Wallace should report?

A. $0

B. $175,000 long-term capital gain.

C. $175,000 ordinary income.

D. $200,000 long-term capital gain.