CPA-REGULATION Online Practice Questions and Answers

On February 1, 1993, Hall learned that he was bequeathed 500 shares of common stock under his father's will. Hall's father had paid $2,500 for the stock in 1990. Fair market value of the stock on February 1, 1993, the date of his father's death, was $4,000 and had increased to $5,500 six months later. The executor of the estate elected the alternate valuation date for estate tax purposes. Hall sold the stock for $4,500 on June 1, 1993, the date that the executor distributed the stock to him. How much income should Hall include in his 1993 individual income tax return for the inheritance of the 500 shares of stock, which he received from his father's estate?

A. $5,500

B. $4,000

C. $2,500 D. $0

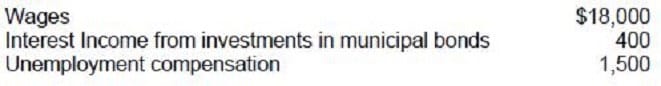

During 2001, Adler had the following cash receipts:

What is the total amount that must be included in gross income on Adler's 2001 income tax return?

A. $18,000

B. $18,400

C. $19,500

D. $19,900

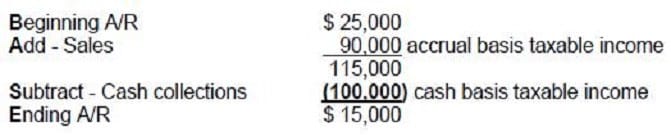

Mosh, a sole proprietor, uses the cash basis of accounting. At the beginning of the current year, accounts receivable were $25,000. During the year, Mosh collected $100,000 from customers. At the end of the year, accounts receivable were $15,000. What was Mosh's gross taxable income for the current year?

A. $75,000

B. $90,000

C. $100,000

D. $110,000

Smith made a gift of property to Thompson. Smith's basis in the property was $1,200. The fair market value at the time of the gift was $1,400. Thompson sold the property for $2,500. What was the amount of Thompson's gain on the disposition?

A. $0

B. $1,100

C. $1,300

D. $2,500

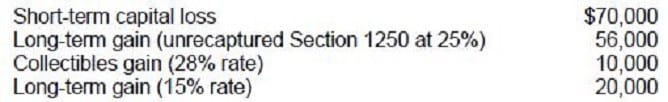

An individual had the following capital gains and losses for the year:

What will be the net gain (loss) reported by the individual and at what applicable tax rate(s)?

A. Long-term gain of $16,000 at the 15% rate.

B. Short-term loss of $3,000 at the ordinary rate and long-term capital gain of $86,000 at the 15% rate.

C. Long-term capital gain of $3,000 at the 15% rate, collectibles gain of $10,000 at the 28% rate, and Section 1250 gain of $56,000 at the 25% rate.

D. Short-term loss of $3,000 at the ordinary rate, long-term capital gain of $10,000 at the 15% rate, collectibles gain of $10,000 at the 28% rate, and Section 1250 gain of $56,000 at the 25% rate.

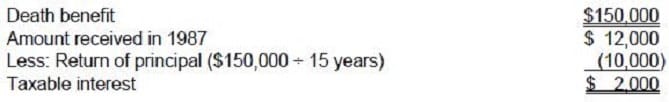

Under a $150,000 insurance policy on her deceased father's life, May Green is to receive $12,000 per year for 15 years. Of the $12,000 received in 1987, the amount subject to income tax is:

A. $0

B. $1,000

C. $2,000

D. $12,000

Cobb, an unmarried individual, had an adjusted gross income of $200,000 in 1990 before any IRA deduction, taxable social security benefits, or passive activity losses. Cobb incurred a loss of $30,000 in 1990 from rental real estate in which he actively participated. What amount of loss attributable to this rental real estate can be used in 1990 as an offset against income from nonpassive sources?

A. $0

B. $12,500

C. $25,000

D. $30,000

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040. The Moores received a $500 security deposit on their rental property in 1994. They are required to return the amount to the tenant.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000

K. $10,000

L. $25,000

M. $50,000

N. $55,000

O. $75,000

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040. In 1994, Joan received $1,300 in unemployment compensation benefits. Her employer made a $100 contribution to the unemployment insurance fund on her behalf.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000

K. $10,000

L. $25,000

M. $50,000

N. $55,000

O. $75,000

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040. The Moores received a stock dividend in 1994 from Ace Corp. They had the option to receive either cash or Ace stock with a fair market value of $900 as of the date of distribution. The par value of the stock was $500.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000

K. $10,000

L. $25,000

M. $50,000

N. $55,000

O. $75,000