CMA Online Practice Questions and Answers

A major justification for investments in computer-integrated manufacturing (CIM) projects is

A. Reduction in the costs of spoilage, reworked units, and scrap.

B. Lower book value and depreciation expense for factory equipment.

C. Increased working capital.

D. Stabilization of market share.

An example of an internal nonfinancial benchmark is the

A. Labor rate of comparably skilled employees at a major competitor's plant.

B. Average actual cost per pound of a specific product at the company's most efficient plant becoming the benchmark for the company's other plants.

C. Company setting a benchmark of $50,000 for employee training programs at each of the company's plants.

D. Percentage of customer orders delivered on time at the company's most efficient plant becoming the benchmark for the company's other plants.

Structural considerations affecting the threat of substitutes include all of the following expect

A. Relative prices

B. Brand identity

C. Cost of switching to substitutes.

D. Customers' inclination to use a substitute.

Online analytical processing allows a user to A. Discover hidden relationships in data.

B. Have multiple perspectives of the same data.

C. Access the data across the Internet.

D. Discover sequences of events in the data.

If the average age of inventory is 60 days, the average age of the accounts payable is 30 days, and the average age of accounts receivable is 45 days, the number of days in the cash flow cycle is

A. 135 days.

B. 90 days.

C. 75 days.

D. 105 days.

The interest rate on the bonds is greater to Rogers. Inc. for the second alternative consisting of pure debt than it is for the first alternative consisting of both debt and equity because the

A. Diversity of the combination alternative creates greater risk for the investor.

B. Pure debt alternative would flood the market and be more difficult to sell.

C. Pure debt alternative carries the risk of increasing the probability of default,

D. Combination alternative carries the risk of increasing dividend payments.

The type of open that does not have the barong of stock is called a(n)

A. Covered option,

B. Unsecured option.

C. Naked option

D. Put option.

The margin of safety is a key concept of CVP analysis. The margin of safety is the

A. Contribution margin rate.

B. Difference between budgeted contribution margin and Break even contribution margin.

C. Difference between budgeted sales and breakeven sales.

D. Difference between the breakeven point in sales and cash flow breakeven.

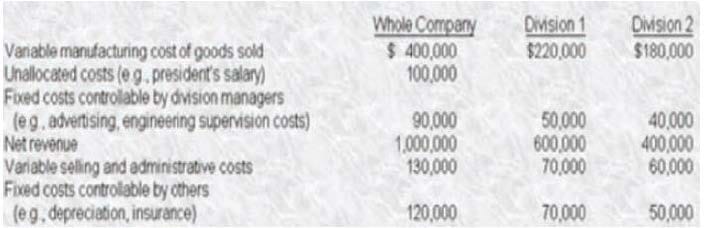

The data available for the current year are given below.

using the information presented above, the contribution by Division I was?

A. $190000

B. $260,000

C. $310.000

D. $380 000

Whatney Co. is considering the acquisition of a new, more efficient press. The cost of the press is $360,000, and the press has an estimated 6-year life with zero salvage value. Whatney uses straight-line depreciation for both financial reporting and income tax reporting purposes and has a 40% corporate income tax rate. In evaluating equipment acquisitions of this Pjpe, Whatney uses a goal of a 4-year payback period. To meet Whatney's desired payback period, the press must produce a minimum annual before-tax operating cash savings of

A. $90,000

B. $110,000

C. $114,000

D. $150,000