BUSINESS-ENVIRONMENT-AND-CONCEPTS Online Practice Questions and Answers

Leslie, Kelly, and Blair wanted to form a business. Which of the following business entities does not require the filing of organization documents with the state?

A. Limited partnership.

B. Joint venture.

C. Limited liability company.

D. Subchapter S corporation.

A parent corporation owned more than 90% of each class of the outstanding stock issued by a subsidiary corporation and decided to merge that subsidiary into itself. Under the Revised Model Business Corporation Act, which of the following actions must be taken?

A. The subsidiary corporation's board of directors must pass a merger resolution.

B. The subsidiary corporation's dissenting stockholders must be given an appraisal remedy.

C. The parent corporation's stockholders must approve the merger.

D. The parent corporation's dissenting stockholders must be given an appraisal remedy.

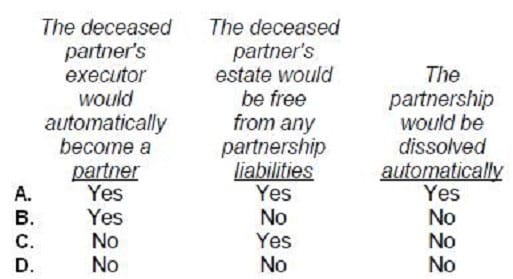

Unless otherwise provided in a general partnership agreement, which of the following statements is correct when a partner dies?

A. Option A

B. Option B

C. Option C

D. Option D

Which of the following segments of the economy will be least affected by the business cycle?

A. Commercial construction industry.

B. Machinery and equipment industry.

C. Residential construction industry.

D. Healthcare industry.

Which of the following is most likely to cause an increase in the amount of frictional unemployment in an economy?

A. An invention that renders an industry obsolete.

B. A downturn in aggregate business activity.

C. An increase in the average age of the work force.

D. A reduction in the average age of the work force.

Which of the following methods is designed to measure transaction exposure in terms of the maximum one day loss related to holdings denominated in foreign currency?

I. Measurement of currency variability.

II. Measurement of currency correlations.

III.

Value at risk.

A.

I only.

B.

II only.

C.

III only.

D.

I, II, and III.

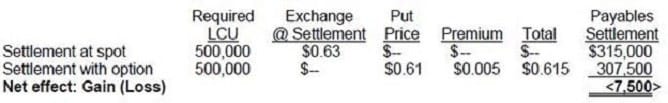

Hedgehog International has a receivable valued at 500,000 local currency units from its foreign customer due in 90 days. The current spot rate of the local currency unit is $.60. Hedgehog purchases a put option to sell the local currency unit in 90 days for $.61 for a premium of $.005. The exchange rate for the local currency increases to $.63 in 90 days. What will Hedgehog do on the receivable's settlement date?

A. Hedgehog will exercise its option and sell the proceeds of its accounts receivable collection under the provisions of the option contract at a gain.

B. Hedgehog will not exercise the option and sell local currency units collected from its receivable at the spot rate.

C. Hedgehog will be indifferent as to whether it exercises the option or not.

D. Hedgehog will sell the option at the settlement date and combine its proceeds along with local currency units purchased at the spot rate to maximize its revenue.

If Brewer Corporation's bonds are currently yielding 8 percent in the marketplace, why would the firm's cost of debt be lower?

A. Market interest rates have increased.

B. Additional debt can be issued more cheaply that the original debt.

C. Interest is deductible for tax purposes.

D. There is a mixture of old and new debt.

The internal rate of return for a project can be determined:

A. Only if the project cash flows are constant.

B. By finding the discount rate that yields a net present value of zero for the project.

C. By subtracting the firm's cost of capital from the project's profitability index.

D. Only if the project's profitability index is greater than one.

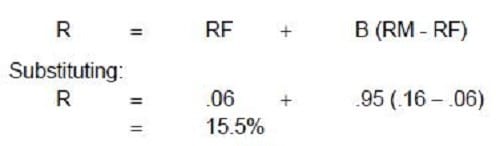

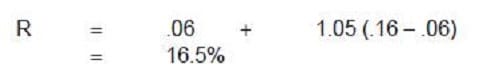

Datacomp Industries, which has no current debt, has a beta of .95 for its common stock. Management is considering a change in the capital structure to 30% debt and 70% equity. This change would increase the beta on the stock to 1.05, and the after-tax cost of debt will be 7.5%. The expected return on equity is 16%, and the risk-free rate is 6%. Should Datacomp's management proceed with the capital structure change?

A. No, because the cost of equity capital will increase.

B. Yes, because the cost of equity capital will decrease.

C. Yes, because the weighted average cost of capital will decrease.

D. No, because the weighted average cost of capital will increase.